AI in Sri Lankan banking is accelerating as private commercial banks look for data‑driven ways to improve loan decisions and credit‑risk assessment. Let’s examine the evolving landscape of Artificial Intelligence (AI) within the financial sector. We will specifically focus on its application and acceptance in Sri Lankan commercial banks.

My research explores how AI-powered tools are changing traditional practices like loan decision-making and risk assessment. It also looks at the factors influencing their adoption by banking professionals. Join me as I examine the challenges, opportunities, and human elements behind this technological shift in finance.

Sri Lankan private commercial banks encounter various challenges when making loan decisions and assessing risks. These challenges often arise from information asymmetry. This occurs when borrowers may have more information about their creditworthiness than lenders (CBSL, 2023). Loan officers often experience time constraints and heavy workloads. These issues can hinder their ability to thoroughly evaluate loan applications and accurately assess risk (CBSL, 2023). This may lead to inconsistent decision-making. As a result, there can be missed opportunities and increased credit risk.

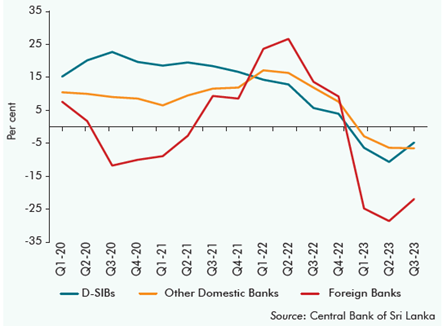

The Financial Stability Review (2023) of the Central Bank of Sri Lanka emphasizes the high Stage 3 Loans Ratio. This shows many non-performing loans in the banking sector. This highlights the need for banks to improve their ability to assess credit risks. Additionally, they must make loan decisions more efficiently. Prediction algorithms powered by AI use large amounts of data and advanced analytical techniques. These offer a potential solution to these issues.

Global lessons for AI in Sri Lankan banking

The integration of Artificial Intelligence (AI) into banking isn’t unique to Sri Lanka. It’s a global phenomenon reshaping how financial institutions operate. Understanding this broader context helps appreciate both the potential and the specific challenges faced locally.

AI’s Global Footprint in Finance

Around the world, banks are leveraging AI, particularly machine learning and data analytics, for various functions:

- Enhanced Credit Scoring: AI algorithms can analyze vast amounts of traditional and alternative data. Thus, they create more accurate predictions of borrower creditworthiness than traditional models alone.

- Improved Efficiency: Automating parts of the loan application process, from data entry to initial risk assessment, frees up human officers for more complex tasks.

- Robust Risk Management: AI can identify subtle patterns and emerging risks within loan portfolios much faster than manual analysis, enabling proactive mitigation. (Purificato et al., 2022)

- Personalized Services: Some banks use AI for robo-advisors or tailoring product offerings, although our focus here is on the loan process.

Potential Hurdles Seen Globally

Despite the benefits, banks worldwide also grapple with challenges:

- Algorithmic Bias: AI systems trained on historical data can inadvertently perpetuate existing societal biases if not carefully designed and audited.

- Transparency Issues: The complex nature of some AI models (the “black box” problem) can make it difficult to understand why a specific decision was recommended. This poses challenges for regulation and user trust.

- Implementation Costs & Expertise: Integrating AI requires significant investment in technology and skilled personnel.

“Integrating intelligence (AI) in the global banking sector is revolutionizing loan decisions and risk evaluation. AI algorithms like machine learning, deep learning, and neural networks analyze vast datasets to uncover valuable insights.” (Balakrishnan et al., 2023)

As Sri Lankan banks explore AI, they can learn from these global experiences. They can adopt best practices while navigating the specific hurdles and opportunities within the local financial landscape. The journey involves not just adopting technology, but doing so responsibly and effectively.

Human factors driving AI in Sri Lankan banks

Introducing powerful AI tools for loan analysis is one thing; ensuring banking professionals actually use them effectively is another challenge entirely. The success of AI implementation hinges significantly on user acceptance. Why might a loan officer embrace or resist a new AI-powered system designed to help them?

Understanding Technology Adoption

Researchers often use models to understand how people adopt new technologies. One prominent framework is the Technology Acceptance Model 3 (TAM3). While it sounds complex, the core ideas are quite intuitive. They highlight key factors influencing a user’s decision to adopt a technology:

- Perceived Usefulness (PU): Does the loan officer believe the AI tool will actually help them do their job better? Will it improve accuracy, efficiency, or provide valuable insights for assessing loan defaults?

- Perceived Ease of Use (PEOU): How easy does the loan officer think the AI tool will be to learn and operate? Is the interface user-friendly? Does it integrate smoothly into their existing workflow?

TAM3 suggests that PEOU can also influence PU – if a tool is easy to use, people are more likely to find it useful.

Other Crucial Influences

Beyond these core perceptions, other factors play a significant role, especially in a professional banking context:

- External Controls: Does the bank provide adequate training, resources, and technical support? Is there management encouragement or peer pressure to use the system?

- Individual Factors: Things like an employee’s prior experience with technology, their general comfort level (or anxiety) with computers, and their confidence in their own ability to use the tool (Computer Self-Efficacy) matter.

- Employee Experience: An officer’s years of experience in banking might shape how they view the necessity or benefit of an AI assistant.

“However, the effective implementation of AI in this context depends on factors, including how loan officers perceive and embrace the technology.”

Understanding these human factors is vital for banks seeking to successfully integrate AI. It’s not just about the algorithm; it’s about supporting the people who interact with it.

The Challenge: Navigating Loan Risk in Sri Lanka’s Banks

Sri Lankan private commercial banks operate in a complex environment when it comes to making loan decisions and assessing credit risk. Understanding the challenges they face is key to appreciating why technologies like Artificial Intelligence (AI) are gaining attention.

Key Challenges Faced

Traditional loan approval processes often grapple with several core difficulties:

- Information Asymmetry: Borrowers often possess more detailed information about their financial health and intentions than lenders. This makes accurate risk assessment difficult.

- Time Constraints & Workload: Loan officers frequently manage heavy workloads, limiting the time available for in-depth analysis of each application.

- Inconsistent Decision-Making: Reliance on individual human judgment can lead to variability in lending decisions across different officers or branches.

- Non-Performing Loans (NPLs): As highlighted by the Central Bank of Sri Lanka (CBSL), certain sectors show high ratios of Stage 3 loans (loans significantly past due). This indicates underlying issues in credit risk management (See gallery below).

These factors contribute to potential missed lending opportunities on one hand, and increased credit risk exposure on the other.

“AI driven predictive algorithms offer solutions to various challenges within the lending sector. By leveraging data analysis and machine learning methods, these algorithms aim to simplify loan approval procedures, enhance risk assessment precision, and boost the effectiveness of loan officers.”

Addressing these challenges is crucial not only for individual banks but for the overall stability of the financial sector. This sets the stage for exploring how AI might provide more efficient, consistent, and data-driven approaches to loan assessment.

Motivation and Significance

The motivation is to understand the impact of AI-powered algorithms on the banking industry in Sri Lanka. This focuses specifically on loan decision-making and risk assessment. The Central Bank of Sri Lanka’s Financial Stability Review (2023) highlighted the challenges the Sri Lankan banking sector faces in these areas. Issues like information asymmetry, time constraints, and the need for consistent decision-making affect this sector. These challenges might have led to higher levels of non-performing loans. They also pose risks to the overall stability of the banking sector in Sri Lanka.

AI driven predictive algorithms offer solutions to various challenges within the lending sector. By leveraging data analysis and machine learning methods, these algorithms aim to simplify loan approval procedures and enhance risk assessment precision. They also boost the effectiveness of loan officers (Purificato et al., 2022). However, the effective implementation of AI in this context depends on factors including how loan officers perceive and embrace the technology (Mathipriya et al., 2019).

CBSL. (2023, November 3). Financial Stability Review 2023. https://www.cbsl.gov.lk/sites/default/files/cbslweb_images/publications/fssr/fssr_2023e.pdf

Mathipriya, B., Minhaj, I., Rodrigo, L., Abiylackshmana, P., & Kahandawaarachchi, K. (2019, December 1). Employee Readiness towards Artificial Intelligence in Sri Lankan Banking Context. https://doi.org/10.1109/smartnets48225.2019.9069797

Purificato, E., Lorenzo, F., Fallucchi, F., & Luca, E W D. (2022, June 12). The Use of Responsible Artificial Intelligence Techniques in the Context of Loan Approval Processes. https://doi.org/10.1080/10447318.2022.2081284