Cite this article

Arachchige, Kushan Liyana (2025) Investment Appraisal Exercise 08, Research Mind. Available at: https://kush.jp.net/investment-appraisal-exercise-08/ (Accessed on: February 21, 2026 at 23:52)

Asela & Sons PLC is evaluating three investment projects, whose expected cash flows are given in following table. Calculate the net present value for each project if Asela & Sons’ cost of capital is 12 percent and suggest which of the two projects should be selected.

| Period | Project A | Project B | Project C |

| 0 | (11,000) | (22,000) | (33,000) |

| 1 | 3000 | 6000 | 11000 |

| 2 | 3000 | 6000 | 10000 |

| 3 | 3000 | 6000 | 10000 |

| 4 | 3000 | 6000 | 10000 |

| 5 | 3000 | 6000 | 5000 |

| 6 | 3000 | 6000 | 1000 |

| 7 | – | 6000 | – |

Calculate the following.

- The payback period using payback method

- Accounting rate of return (ARR)

- Net present value method (NPV)

- Internal rate of return (IRR)

Assume the discount rate is 12%. Scrap Value is 0.

Select the best project to invest.

Formulas

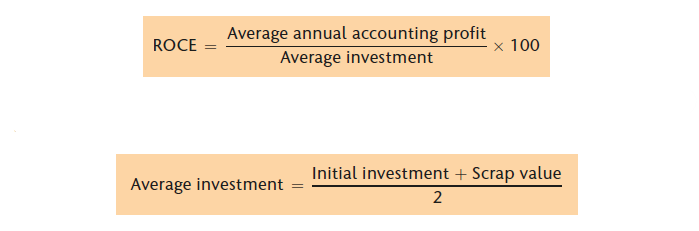

Accounting Rate of Return (ARR)

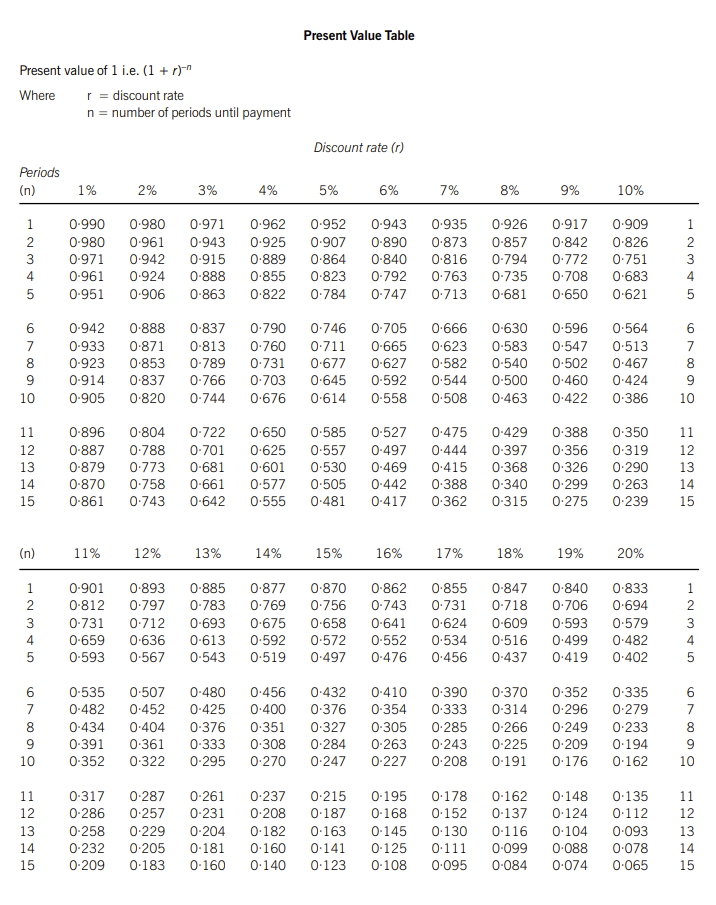

Net Present Value (NPV)

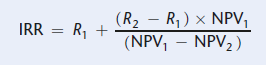

Internal Rate of Return

Answers

Payback Period

Project A: 3Y + 8M

Project B: 3Y + 8M

Project C: 3Y + 3M

ARR

Project A: 21.21%

Project B: 25.97%

Project C: 14.14%

NPV at DCF 12%

Project A: 1336

Project B: 5384

Project C: 1615

IRR

Project A: 16.53%

Project B: 19.48%

Project C: 14.32%

Cite this article

Arachchige, Kushan Liyana (2025) Investment Appraisal Exercise 08, Research Mind. Available at: https://kush.jp.net/investment-appraisal-exercise-08/ (Accessed on: February 21, 2026 at 23:52)