Cite this article

Arachchige, Kushan Liyana (2025) Investment Appraisal Exercise 10, Research Mind. Available at: https://kush.jp.net/investment-appraisal-exercise-10/ (Accessed on: February 21, 2026 at 23:50)

Erandi Perera PLC is evaluating three investment projects, whose expected cash flows are given in following table. Calculate the net present value for each project if Erandi Perera’s cost of capital is 10 percent and suggest which of the two projects should be selected.

| Period | Project A | Project B | Project C |

| 0 | (100,000) | (250,000) | (550,000) |

| 1 | 20000 | 50000 | 100000 |

| 2 | 20000 | 50000 | 100000 |

| 3 | 50000 | 100000 | 100000 |

| 4 | 50000 | 100000 | 200000 |

| 5 | 20000 | 100000 | 100000 |

| 6 | 20000 | 35000 | 100000 |

| 7 | – | – | 100000 |

Calculate the following.

- The payback period using payback method

- Accounting rate of return (ARR)

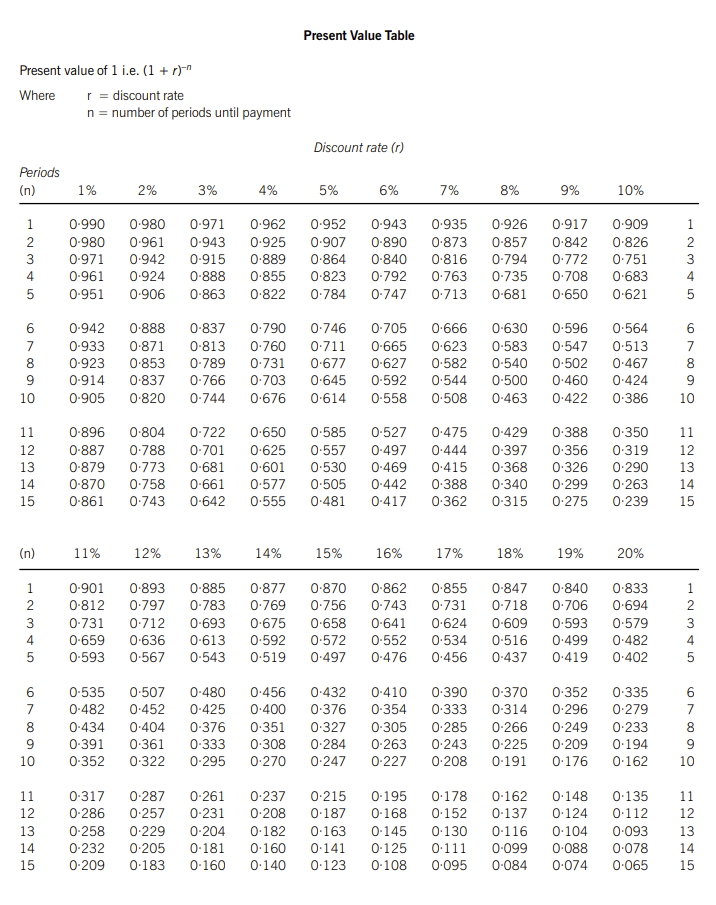

- Net present value method (NPV)

- Internal rate of return (IRR)

Assume the discount rate is 10%. Scrap Value is 25,000.

Select the best project to invest.

Formulas

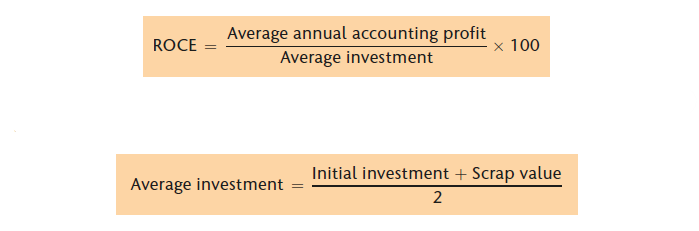

Accounting Rate of Return (ARR)

Net Present Value (NPV)

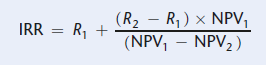

Internal Rate of Return

Answers

Payback Period

Project A: 3Y + 3M

Project B: 3Y + 6M

Project C: 4Y + 6M

ARR

Project A: 28.00%

Project B: 25.45%

Project C: 13.66%

NPV at DCF 10%

Project A: 30100

Project B: 61990

Project C: 5000

IRR

Project A: 19.47%

Project B: 17.99%

Project C: 10.34%

Cite this article

Arachchige, Kushan Liyana (2025) Investment Appraisal Exercise 10, Research Mind. Available at: https://kush.jp.net/investment-appraisal-exercise-10/ (Accessed on: February 21, 2026 at 23:50)