Cite this article

Arachchige, Kushan Liyana (2025) Investment Appraisal Exercise 11, Research Mind. Available at: https://kush.jp.net/investment-appraisal-exercise-11/ (Accessed on: February 21, 2026 at 23:50)

Erandi Perera PLC is evaluating three investment projects, whose expected cash flows are given in following table. Calculate the net present value for each project if Erandi Perera’s cost of capital is 12 percent and suggest which of the two projects should be selected.

| Period | Project A | Project B | Project C |

| 0 | (75,000) | (135,000) | (265,000) |

| 1 | 17000 | 25000 | 50000 |

| 2 | 17000 | 25000 | 100000 |

| 3 | 17000 | 50000 | 100000 |

| 4 | 17000 | 50000 | 50000 |

| 5 | 17000 | 25000 | 50000 |

| 6 | 17000 | 25000 | 50000 |

| 7 | 17000 | 25000 | 50000 |

Calculate the following.

- The payback period using payback method

- Accounting rate of return (ARR)

- Net present value method (NPV)

- Internal rate of return (IRR)

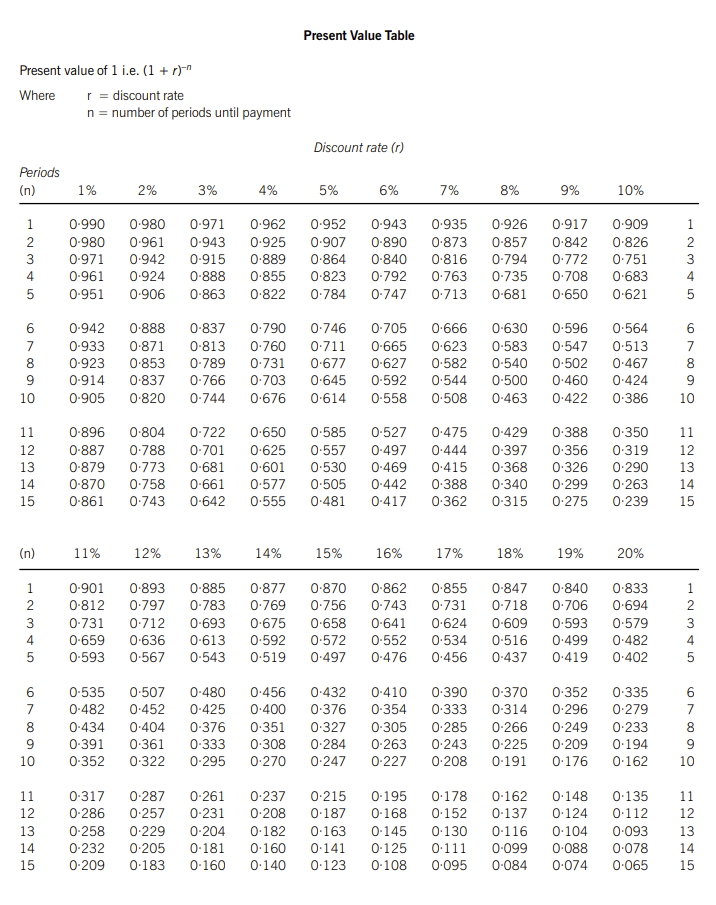

Assume the discount rate is 12%. Scrap Value is 10000.

Select the best project to invest.

Formulas

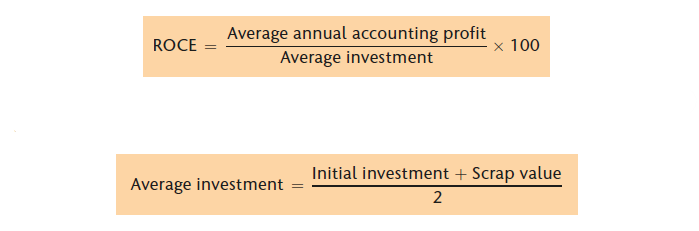

Accounting Rate of Return (ARR)

Net Present Value (NPV)

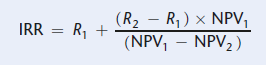

Internal Rate of Return

Answers

Payback Period

Project A: 4Y + 5M

Project B: 3Y + 9M

Project C: 3Y + 4M

ARR

Project A: 18.15%

Project B: 19.70%

Project C: 20.26%

NPV at DCF 12%

Project A: 2588

Project B: 12800

Project C: 38650

IRR

Project A: 13.27%

Project B: 15.28%

Project C: 17.17%

Cite this article

Arachchige, Kushan Liyana (2025) Investment Appraisal Exercise 11, Research Mind. Available at: https://kush.jp.net/investment-appraisal-exercise-11/ (Accessed on: February 21, 2026 at 23:50)