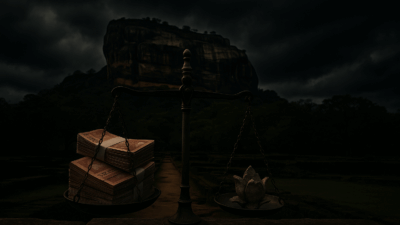

Sri Lankan television broadcasting market is gaining momentum as advertisers return and the 2027 analog switch-off looms. In 2025, stabilising GDP, a US$254 m digital-ad boom, and JICA-funded ISDB-T infrastructure converge to transform cost structures, channel reach, and viewer habits. Broadcasters that misread the pace of change risk ceding prime-time eyeballs to OTT newcomers, smartphones, and regional streamers. Inside, you’ll find five-year revenue curves, profitability and cost benchmarks for HD upgrades, and a map of political-regulatory hurdles shaping licence renewals. Read on to see how TV Derana claims the lead.

Recap

Sri Lanka’s television broadcasting market, valued at $220 million in 2024, presents significant growth opportunities despite economic challenges. With 79% household TV penetration—the highest in South Asia—the market is projected to reach $340 million by 2030 (7.6% CAGR).

Critical Market Drivers:

- Digital transformation to ISDB-T standard by 2027

- Economic recovery with 5% GDP growth in 2024

- Rising internet penetration from 35% to 66.7%

- Digital advertising growth at 6.64% CAGR

Competitive Landscape: Five major players dominate: Rupavahini (95% coverage), Sirasa/MTV, Hiru TV, TV Derana, and Dialog TV (1.7M subscribers). TV Derana holds strong positioning in news broadcasting and digital platforms.

Strategic Opportunities:

- Lead digital terrestrial transition

- Develop OTT streaming capabilities

- Export content to regional markets

- Leverage 60% import tax for local production advantage

Key Challenges:

- OTT competition reaching 50.5% penetration by 2027

- Power infrastructure vulnerabilities

- Currency volatility (LKR 131-364 vs USD)

- Regulatory changes with new Broadcasting Commission

Investment Requirements:

- $10-20M for ISDB-T infrastructure

- $5-10M for streaming platform enhancement

- 30% increase in local content budget

The 2024-2033 period represents a transformative decade for Sri Lankan broadcasting, with winners emerging from those who successfully balance traditional TV strength with digital innovation.

Market Dynamics and Growth Trajectory

The television broadcasting sector in Sri Lanka represents one of South Asia’s most penetrated markets, with 79% of households owning television sets, significantly exceeding regional peers like India at 70% and Bangladesh at 64% (6Wresearch, 2024). The market’s current valuation of US$220 million reflects a remarkable per capita revenue of US$10.00, positioning Sri Lanka as the regional leader in television market value per person, despite its smaller absolute market size compared to neighboring countries (Statista, 2024).

This market leadership emerges from several interconnected factors that shape the industry’s growth trajectory. The country’s economic recovery following the 2019-2024 crisis has created renewed momentum, with GDP growth reaching 5% in 2024 and projected to stabilize at 3.5% for 2025 (World Bank, 2025). This economic stabilization provides the foundation for advertising revenue growth, which constitutes 70-80% of broadcaster revenues in the free-to-air segment that dominates Sri Lankan television.

The growth projections for the industry vary significantly depending on the analytical lens applied. Conservative estimates suggest a modest 1.59% compound annual growth rate (CAGR), reaching US$225.5 million by 2029, while more optimistic television-specific forecasts project a 7.6% CAGR, potentially expanding the market to US$340 million by 2030 (6Wresearch, 2024). This divergence in projections reflects the uncertainty surrounding digital transformation adoption rates and the pace of economic recovery.

Digital advertising growth serves as a critical catalyst for the broadcasting sector’s expansion. The digital advertising market, valued at US$254 million in 2025, is projected to reach US$308 million by 2028, representing a 6.64% CAGR (Statista, 2024). This growth directly benefits broadcasters who are increasingly integrating digital platforms into their traditional broadcasting operations, creating hybrid models that capture both linear television viewers and digital audiences.

Competitive Landscape and Market Structure

The Sri Lankan television broadcasting market exhibits characteristics of a mature oligopoly, with five major players controlling the majority of viewership and advertising revenue. This market structure emerged following the liberalization of broadcasting in 1992, which ended the state monopoly and introduced private sector competition (Wikipedia, 2024).

Sri Lanka Rupavahini Corporation (SLRC), the state broadcaster, maintains the dominant position with 95% geographic coverage through its four channels, leveraging government support and infrastructure advantages that private broadcasters struggle to match (Wikipedia, 2024). Despite this coverage advantage, SLRC reported losses of LKR 277 million in 2023, highlighting the challenges of operating a public service broadcaster in a competitive market (Statemediamonitor, 2024).

The private sector leaders have carved distinct market positions through strategic differentiation. Capital Maharaja Group’s Sirasa and MTV channels reach 85% of households, combining strong local content production with international programming to appeal to diverse audience segments (Jamco, 2024). Hiru TV, owned by Asia Broadcasting Corporation, pioneered high-definition broadcasting in Sri Lanka and commands premium advertising rates through its focus on quality programming and news content.

TV Derana, established in 2005, has built a strong position in news broadcasting and achieved significant digital milestones, becoming the first Sri Lankan television channel to reach one billion views on YouTube in 2019 (Wikipedia, 2024). This digital success demonstrates TV Derana’s ability to adapt to changing viewer preferences and leverage new platforms for audience growth.

Dialog TV operates in a different segment as the dominant pay-TV provider, serving over 1.7 million subscribers through its direct-to-home satellite service (Wikipedia, 2024). The company’s 2024 acquisition of Airtel Lanka further consolidated its market position, creating opportunities for bundled telecommunications and broadcasting services that reshape competitive dynamics.

The competitive intensity in the market manifests through several battlegrounds. Content wars drive significant investment in local production, particularly teledramas that dominate prime-time viewing between 6:30 PM and 10:30 PM. Technology races push broadcasters to upgrade transmission capabilities, with the transition to ISDB-T digital terrestrial television creating both opportunities and challenges for market participants (TheMonitor, 2024).

Technological Transformation and Infrastructure Development

The technological landscape of Sri Lankan broadcasting is undergoing fundamental transformation, driven by the government’s commitment to digital terrestrial television broadcasting. The adoption of the Japanese ISDB-T standard, supported by Japan International Cooperation Agency (JICA) funding, represents a watershed moment for the industry (Abu, 2022). This transition, scheduled for completion by 2027, will multiply channel capacity eightfold, enabling over 200 channels compared to the current analog limitations.

The digital transformation extends beyond terrestrial broadcasting to encompass the entire value chain. Dialog TV has implemented DVB-S2/8PSK technology via Intelsat 38, offering 140+ channels including 11 in high definition (Wikipedia, 2024). Sri Lanka Telecom’s PEO TV leverages IPTV technology to provide time-shift capabilities, video-on-demand services, and multi-screen viewing options, representing the convergence of telecommunications and broadcasting.

Infrastructure development faces significant challenges that impact operational reliability and service quality. The December 2023 nationwide power outage lasting 5.5 hours exemplified the vulnerability of broadcasting operations to infrastructure failures (Associated Press, 2023). This incident, following similar blackouts in previous years, underscores the critical importance of backup power systems and infrastructure resilience for broadcasters maintaining 24/7 operations.

Internet infrastructure presents both opportunities and constraints for digital broadcasting expansion. Fixed broadband speeds averaging 27.42 Mbps and mobile speeds of 37.94 Mbps lag behind regional standards, potentially limiting streaming quality and adoption rates (Worlddata, 2024). The absence of operational 5G networks as of 2024 further constrains the potential for mobile broadcasting innovations that could expand audience reach and engagement.

The Lotus Tower in Colombo serves as the command center for digital broadcasting transformation, coordinating with eight transmission towers strategically positioned across the island. This infrastructure investment, while substantial, promises to revolutionize broadcasting capabilities, enabling emergency warning systems, interactive services, and enhanced picture quality that will redefine viewer experiences.

Consumer Behavior and Market Segmentation

Understanding viewer preferences and consumption patterns reveals a complex tapestry of traditional and emerging behaviors that shape broadcasting strategies. The Sri Lankan television audience, while maintaining strong attachment to traditional viewing, increasingly embraces multi-platform consumption models that blur boundaries between linear and on-demand content.

Rural audiences, comprising 80.6% of the population, demonstrate distinct viewing patterns centered on communal television experiences and preference for Sinhala-language content, particularly locally produced teledramas (DataReportal, 2024). This segment’s loyalty to scheduled programming creates reliable audience bases for advertisers but also presents challenges for introducing new viewing behaviors and technologies.

Urban English-speaking professionals represent a smaller but economically significant segment, driving adoption of smart TVs, streaming services, and international content consumption. This audience segment’s willingness to pay for premium content and early adoption of new technologies makes them attractive targets for subscription-based models and advanced broadcasting services.

The linguistic diversity of Sri Lanka necessitates careful content strategies, with approximately 70% of viewers preferring Sinhala content, 20% Tamil, and 10% English (Jamco, 2024). This distribution creates opportunities for targeted channel strategies but also fragments the market, requiring broadcasters to balance efficiency with audience reach.

Youth audiences aged 15-29 present the greatest challenge and opportunity for traditional broadcasters. Their migration to digital platforms, particularly YouTube with 7.23 million users, Facebook with 7.5 million users, and TikTok reaching 27.8% of adults over 18, signals fundamental shifts in media consumption patterns (DataReportal, 2024). These platforms compete directly with television for attention and advertising revenue, forcing broadcasters to develop omnichannel strategies that meet audiences where they consume content.

The rise of over-the-top (OTT) streaming services compounds competitive pressures, with penetration reaching 44.4% and projected to exceed 50.5% by 2027 (Statista, 2024). However, the Sri Lankan market demonstrates unique characteristics that moderate OTT disruption. Payment method limitations, data costs, and preference for local content create barriers that protect traditional broadcasting while providing time for strategic adaptation.

Regulatory Framework and Policy Environment

The regulatory landscape governing Sri Lankan broadcasting reflects tensions between market liberalization and content control, creating complex compliance requirements that significantly impact operational strategies. The Telecommunications Regulatory Commission of Sri Lanka (TRCSL) serves as the primary technical regulator, managing spectrum allocation, licensing, and equipment standards that form the foundation of broadcasting operations (TRCSL, 2024).

Recent regulatory developments signal potential shifts in governance structures and oversight mechanisms. The proposed Broadcasting Regulatory Commission, comprising five members with powers to suspend licenses, represents a consolidation of regulatory authority that could reshape industry dynamics (TheMonitor, 2024). This development raises concerns about editorial independence and operational certainty, particularly given Sri Lanka’s history of political influence in media regulation.

Licensing requirements create significant barriers to entry while providing incumbent protection. The 10-year license terms for broadcasting operations require substantial upfront investments and long-term commitments that favor established players (CSA Group, 2021). Technical compliance requirements, including mandatory equipment type approvals and IMEI registration for RF-emitting devices effective January 2025, add operational complexity and costs.

Content regulations particularly impact international programming strategies. The 60% import tax on foreign content creates powerful incentives for local production while constraining access to international programming that could diversify channel offerings (6Wresearch, 2024). This protectionist measure, while supporting local creative industries, potentially limits broadcaster flexibility in responding to audience preferences for international content.

Advertising restrictions further shape revenue potential and content strategies. Limitations on food and beverage advertising, complete bans on alcohol and tobacco promotion, and evolving regulations around children’s programming create compliance challenges while potentially reducing available advertising inventory. These restrictions disproportionately impact free-to-air broadcasters dependent on advertising revenue compared to subscription-based models.

Economic Analysis and Business Models

The economics of television broadcasting in Sri Lanka reveal structural challenges and emerging opportunities that define strategic options for market participants. Revenue concentration in advertising creates vulnerability to economic cycles and advertiser bargaining power, while rising content costs pressure profitability margins across the industry.

Advertising revenue dominance characterizes free-to-air broadcasting economics, with 70-80% revenue dependence creating sensitivity to macroeconomic conditions and advertiser spending patterns. The shift of advertising budgets toward digital platforms compounds pressure on traditional broadcasting revenues, necessitating hybrid models that capture both linear and digital advertising opportunities.

Cost structures reveal content as the primary expense category, consuming 40-60% of revenues for competitive broadcasters. This content cost pressure intensifies with audience fragmentation and competition from international platforms offering high-production-value programming. Local content production, while benefiting from import tax protection, requires substantial investments in talent, facilities, and technology that strain broadcaster resources.

Infrastructure and operational costs, representing 15-20% of revenues, include transmission facilities, studio maintenance, and increasingly critical backup power systems. The December 2023 power outage highlighted infrastructure vulnerability costs, both in terms of lost advertising revenue and audience trust erosion. Technology transformation requirements for digital broadcasting add capital expenditure pressures that challenge financial planning.

Human capital investments, particularly in creative talent and technical expertise, constitute 10-15% of revenues but represent critical competitive differentiators. The limited talent pool in Sri Lanka creates wage pressures and retention challenges, particularly for specialized skills in digital broadcasting and content production. Training investments for the digital transition represent necessary but costly preparations for industry transformation.

Working capital management presents particular challenges in the Sri Lankan context. Advertising receivables typically extend 60-90 days, creating cash flow pressures exacerbated by currency volatility. The historical rupee fluctuation from LKR 131 to 364 against the US dollar between 2014 and 2023 illustrates foreign exchange risks that complicate financial planning for broadcasters with international content commitments (6Wresearch, 2024).

Strategic Opportunities and Risk Assessment

The convergence of technological transformation, economic recovery, and evolving consumer preferences creates strategic windows for ambitious broadcasters willing to navigate complexity and invest for long-term success. TV Derana’s established market position, digital capabilities, and news leadership provide foundations for expansion strategies that balance risk and opportunity.

Digital transformation leadership represents the most significant strategic opportunity. Early adoption of ISDB-T technology and comprehensive digital broadcasting capabilities could establish first-mover advantages in channel capacity, service innovation, and operational efficiency. The eightfold increase in channel capacity enables content diversification, targeted audience strategies, and new revenue models previously impossible under analog constraints.

Regional content hub development leverages Sri Lanka’s creative capabilities and cultural connections to export content to larger South Asian markets. The success of Sri Lankan teledramas in regional markets demonstrates potential for content exports that generate foreign currency revenues while building international brand recognition. Strategic partnerships with Indian and Bangladeshi broadcasters could accelerate market entry and reduce risks.

Platform convergence strategies recognize the inevitability of integrated broadcasting-streaming ecosystems. TV Derana’s Gluuoo/DFlix platform provides foundations for comprehensive OTT services that complement traditional broadcasting while capturing digital-native audiences. Investment priorities should balance platform development with content acquisition and user experience optimization.

Risk mitigation requires comprehensive approaches addressing multiple vulnerability dimensions. Currency hedging strategies, while limited in Sri Lankan markets, could include natural hedges through local content production and regional revenue diversification. Power infrastructure risks necessitate investments in backup systems and potentially renewable energy solutions that provide both reliability and cost advantages.

Regulatory risks demand proactive engagement with policymakers and industry associations to shape favorable regulatory evolution. Building relationships with the proposed Broadcasting Regulatory Commission before its establishment could influence operational frameworks and compliance requirements. Demonstrating commitment to public service broadcasting and local content development strengthens political capital for navigating regulatory challenges.

Market Entry and Expansion Recommendations

The strategic imperative for TV Derana centers on leveraging current strengths while building capabilities for future market leadership. This requires balanced investments across technology, content, and market development that position the company for sustainable growth through industry transformation.

Immediate priorities should focus on digital infrastructure preparation, ensuring readiness for the 2027 analog switch-off while maximizing transition period advantages. Technical teams require training on ISDB-T operations, while content strategies should anticipate expanded channel capacity and interactive service possibilities. Strategic partnerships with technology providers could accelerate capability development while managing investment risks.

Content differentiation strategies should balance local production investments with selective international partnerships. The 60% import tax on foreign content creates competitive advantages for strong local production capabilities, but audience preferences for quality international content cannot be ignored. Innovative content sharing arrangements with regional broadcasters could provide access to premium content while managing costs.

Market expansion should proceed through measured steps that build on existing strengths. TV Derana’s news leadership provides platforms for launching specialized channels targeting specific demographics or interests. Business news channels serving Sri Lanka’s growing professional class or children’s educational programming addressing market gaps represent logical extensions that leverage core capabilities.

Financial structuring must address the dual challenges of capital requirements for digital transformation and working capital needs for operational expansion. Exploring strategic investors with complementary capabilities, particularly in technology or content production, could provide both capital and expertise. Revenue diversification beyond advertising dependency through subscription services, content licensing, and digital products reduces vulnerability to economic cycles.

Organizational development investments in talent acquisition, training, and retention create sustainable competitive advantages. Building digital broadcasting expertise through international partnerships and training programs prepares the organization for technology transformation. Fostering innovation cultures that embrace experimentation and rapid learning enables adaptation to fast-changing market conditions.

The path forward for TV Derana requires vision, discipline, and adaptability in navigating Sri Lanka’s transforming television broadcasting landscape. Success depends on balancing traditional broadcasting strengths with digital innovation, leveraging local market knowledge while embracing global best practices, and maintaining financial discipline while investing for growth. The 2024-2033 period will determine market leadership for decades, rewarding broadcasters who successfully navigate digital transformation while serving evolving audience needs in Sri Lanka’s dynamic media ecosystem.

References

6Wresearch (2024). Sri Lanka Television Market |Size, Share, Volume & Trends 2030. Available at: https://www.6wresearch.com/industry-report/sri-lanka-television-market-2020-2026

Abu (2022). Digital terrestrial TV set to start in Sri Lanka in 2023 – ABU. Available at: https://www.abu.org.my/2022/01/03/digital-terrestrial-tv-set-to-start-in-sri-lanka-in-2023/

Associated Press (2023). Sri Lanka experiences a temporary power outage after a main transmission line fails. AP News. Available at: https://apnews.com/article/sri-lanka-crisis-power-outage-imf-ff6c24554d5dcf74160f11740148e3ee

CSA Group (2021). Sri Lanka (TRCSL) – New Type Approval Procedures. Available at: https://www.csagroup.org/global-certification-regulatory-update/sri-lanka-trcsl-new-type-approval-procedures/

DataReportal (2024). Digital 2024: Sri Lanka — DataReportal – Global Digital Insights. Available at: https://datareportal.com/reports/digital-2024-sri-lanka

Jamco (2024). The Current Situation of Sri lanka TV Media and the Challenges Ahead – 24th JAMCO Online International Symposium. Available at: https://www.jamco.or.jp/en/symposium/24/5/

Statista (2024). TV, Radio & Multimedia – Sri Lanka | Market Forecast. Available at: https://www.statista.com/outlook/cmo/consumer-electronics/tv-radio-multimedia/sri-lanka

Statemediamonitor (2024). Sri Lanka Rupavahini Corporation (SLRC) – State Media Monitor. Available at: https://statemediamonitor.com/2024/09/sri-lanka-rupavahini-corporation-slrc/

TheMonitor (2024). Digital Terrestrial Television Broadcasting project: Long-overdue transformation further delayed. The Morning. Available at: https://www.themorning.lk/articles/yfJbOcmqHYWrEjeMFqKA

TRCSL (2024). Telecommunications Regulatory Commission of Sri Lanka. Available at: https://www.trc.gov.lk

Wikipedia (2024). Television in Sri Lanka. Available at: https://en.wikipedia.org/wiki/Television_in_Sri_Lanka

World Bank (2025). Sri Lanka’s Economy Outpaces Growth Projections, More Efforts Needed to Reduce Poverty, Boost Medium-term Growth. Available at: https://www.worldbank.org/en/news/press-release/2025/04/23/sri-lanka-s-economy-outpaces-growth-projections-more-efforts-needed-to-reduce-poverty-boost-medium-term-growth

Worlddata (2024). Mobile communications and Internet in Sri Lanka. Available at: https://www.worlddata.info/asia/sri-lanka/telecommunication.php